Home sale contingencies are a common part of the home-buying and home-selling process. In fact, in May 2020, the National Association of Realtors found that 76% of offers had contingencies. Understanding what contingencies are out there—whether you’re a seller or a buyer—will help your real estate experience run smoothly.

What are Home Sale Contingencies?

Contingencies are protections written into the purchase and sale contract. They’re conditions that must be met for the home sale to move forward. If they aren’t, the buyer or seller can terminate the contract—often without penalty.

Some contingencies are required. For example, a mortgage lender typically requires an appraisal. Others are optional, such as an inspection contingency.

Beware:

Home sale contingencies generally make an offer weaker. As a buyer, try to limit home sale contingencies if and when possible.

8 Most Common Home Sale Contingencies

Your home sale contract will be unique to your situation. However, there’s a good chance it will include at least a few of the most common real estate contingencies.

Financing Contingency

Buyers who purchase a home with a mortgage commonly include a loan contingency (also called a mortgage contingency or financing contingency). By including this contingency, if you’re unable to secure a loan by a set time, you’re able to end the contract or request an extension from the seller.

Financing contingencies include a date by which the buyer must obtain financing. They also include a maximum interest rate and type of financing. This gives buyers the opportunity to back out of the contract if the loan they are able to get has too high of an interest rate.

The FAR/BAR “AS IS” Contract is a standard form used by many Florida realtors that contains a financing contingency.

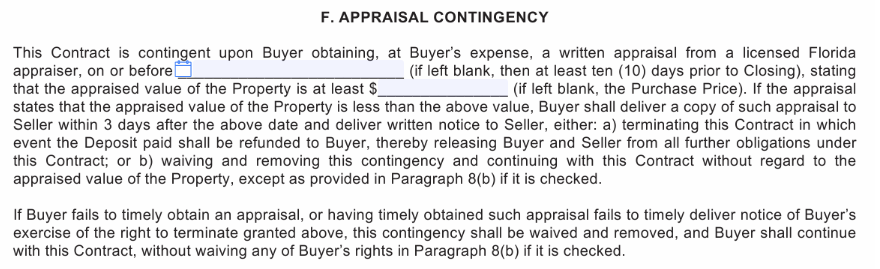

Appraisal Contingency

If you’re buying a home with a mortgage, there’s a good chance your lender will require a professional property appraisal. The bank wants to ensure that the home is worth enough to justify the amount of the loan.

If the appraisal comes back too low and you’re unable to negotiate the sale’s price down, the lender may not be able to lend you enough money to purchase the home. In that case, you would either need to make up the difference with a larger down payment, or you would need to cancel the contract. This contingency allows you to cancel without losing your earnest money.

Florida Appraisal Contingency Rider Language

CR-6 – Appraisal Contingency Rider F (Rev 10_21) (1)

Title Contingency

Most real estate sales contracts automatically include a title contingency. It allows the buyer to walk away from the sale if there’s something wrong with the title. This is crucial because the title is what gives someone the right to own the house.

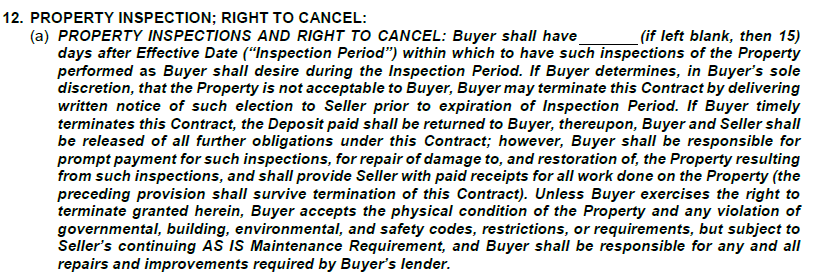

Inspection Contingency

Adding an inspection contingency means that the buyer is going to purchase the home, pending the results of an inspection. Buyers should ALWAYS include an inspection contingency in a home purchase contract. Buying an uninspected home is far too risky, even in a competitive market.

The commonly used Florida AS-IS Contract includes a section called “Property Inspection: Right to Cancel.” This acts as an inspection contingency. The buyer has a set number of days (default is 15 calendar days) to have inspections done on the property and then terminate the contract if desired. This is called the inspection period.

Buyers can back out of a home sale for any reason during an inspection period, even if the inspection doesn’t reveal any problems with the home. If you want to make your offer with an inspection contingency more competitive, consider offering a shorter inspection period.

Florida Inspection Contingency Language

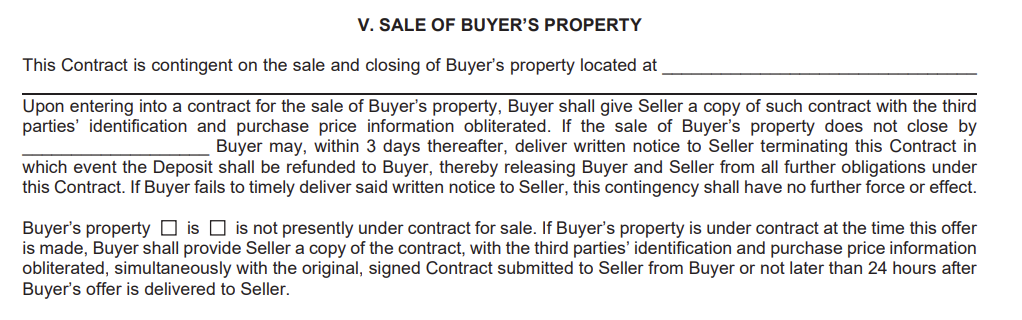

Sale of Buyer Property Contingency

A sale of buyer property contingency (also called a home sale contingency) is a clause you might add to your contract if you’re attempting to sell your home and buy a home at the same time. It makes it so that you can back out of the home sale if your home doesn’t sell within a set amount of time. Think of it as a safety net for buyers.

Florida Sale of Buyer Property Contingency Language

CR-6 – Sale of Buyers Property Rider V (Rev 10_21) (1)

Kick-Out Contingency

Adding any contingencies to a home sale contract can make your offer less attractive to sellers, especially a Sale of Buyer’s Property Contingency. To help make your offer more attractive, it’s helpful to add a kick-out clause. Just as a home sale contingency protects the buyer from risk, a kick-out contingency protects the seller from risk.

A kick-out clause permits a seller to continue to market their home while you’re trying to sell your home. If a better offer comes along, the seller notifies you. Then, you can drop the home sale contingency and move forward with the purchase, or you can walk away without penalty.

Florida realtors use the Kick Out Clause rider.

CR-6 – Kick Out Clause Rider X (Rev 10_21)

Homeowners Association (HOA) Contingency

If you’re purchasing a home within an HOA community or condo association community, an HOA contingency applies. It gives you time to review HOA rules, agreements, and other documents. Rules include details such as pet restrictions, monthly HOA fees, quiet hours, parking, etc.

Florida law gives buyers the right to cancel the sales contract within three days of receiving the required documents. The three-day period doesn’t include weekend days or legal holidays. Considering more than 25% of Florida homeowners belong to an HOA, there’s a good chance you’ll encounter this contingency during your Florida home-buying process.

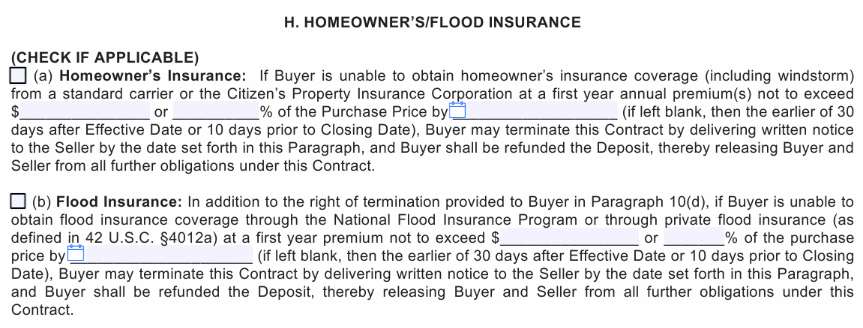

Homeowners Insurance Contingency

Mortgage lenders require buyers to obtain homeowners insurance. Adding a homeowners insurance contingency would enable you to back out of the sale if you’re unable to obtain affordable homeowner’s insurance. For example, if the home is in a flood zone, the cost of the needed insurance might exceed your budget.

Florida Homeowner’s/Flood Insurance Contingency Rider

CR-6 – Homeowners_Flood Insurance Contingency Rider H (Rev 10_21)

Final Thoughts on Common Real Estate Contingencies

Knowing what contingencies to include, or which to prioritize in a competitive market, can get complicated.

A knowledgeable realtor will walk you through the process, helping you put together a competitive offer that also protects your interests and finances.

Each state has its own ways of handling real estate transactions, and you should consult with your real estate agent and attorney on local contracts and laws. The above documents and language are what is currently used in Florida, but may not apply in other locations.