The Florida coastline is filled with condominiums offering affordable waterfront housing with all sorts of fantastic amenities. Let’s explore what a condominium is, what are its advantages and disadvantages, and the things you need to consider before buying a condo in Florida

What Exactly is a Condominium?

A condominium softened shorted to “condo”, is a housing unit that resides in a larger property complex that is sold to individual investors. They can often look similar to apartment buildings, but instead of being rented, each unit is owned.

Owners of the condo will share common amenities of the condo complex and will have to pay monthly fees to maintain the common areas.

If you’ve traveled to the Florida coastline, you would likely have seen many condos near the waterfront.

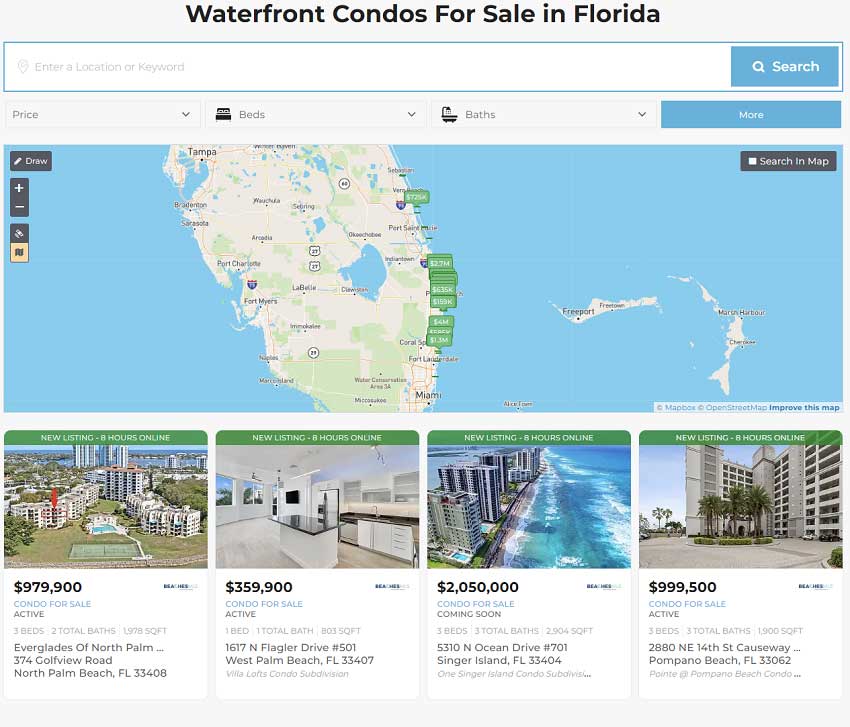

Check Out These Waterfront Condos in Florida

Advantages and Disadvantages of Buying a Condo in Florida

Much like any other piece of real estate, owning a condo comes with certain advantages and disadvantages. Understanding these before buying a condo in Florida is important so you know what you are getting into, and whether condo ownership is right for you or not.

Advantages

- Amenities – Condo ownership in Florida typically comes with some amenities that everyone in the community has access to. Some common examples are; pools, tennis & pickleball courts, beachfront access, boat slips, fitness centers, a clubhouse, game rooms, and more.

- Maintenance-Free Living – Buying a condo in Florida will limit your repairs and maintenance. The Homeowners Association (HOA) will be responsible for maintaining the common areas of the complex, which is everything outside of your condo unit.

- Affordability – Condos are typically significantly more affordable than a single-family home. Condos allow many people to live by the water in Florida, that would otherwise not be able to. In March of 2024 in Palm Beach County the Median Sales price of a Single-Family Home in FL was $599,000 and at the same time, the Median Sales price for a condo was $315,000. On top of this, more condos are located on the water than single-family homes.

- Social Living – Because condo owners share common areas with many neighbors, they often have very active social lives getting to know everyone in the community.

- Security – Most condos offer some level of security systems. Some may have guarded entrances with secure access to the complex, while others may have security cameras everywhere and key-pad lock systems for every single doorway.

Advantages

- Amenities – Condo ownership in Florida typically comes with some amenities that everyone in the community has access to. Some common examples are; pools, tennis & pickleball courts, beachfront access, boat slips, fitness centers, a clubhouse, game rooms, and more.

- Maintenance-Free Living – Buying a condo in Florida will limit your repairs and maintenance. The Homeowners Association (HOA) will be responsible for maintaining the common areas of the complex, which is everything outside of your condo unit.

- Affordability – Condos are typically significantly more affordable than a single-family home. Condos allow many people to live by the water in Florida, that would otherwise not be able to. In March of 2024 in Palm Beach County the Median Sales price of a Single-Family Home in FL was $599,000 and at the same time, the Median Sales price for a condo was $315,000. On top of this, more condos are located on the water than single-family homes.

- Social Living – Because condo owners share common areas with many neighbors, they often have very active social lives getting to know everyone in the community.

- Security – Most condos offer some level of security systems. Some may have guarded entrances with secure access to the complex, while others may have security cameras everywhere and key-pad lock systems for every single doorway.

Disadvantages

- HOA Fees Can Be High – Since many condos are located by the water, and often have many amenities, the HOA dues can often be higher for condos than for a single-family home. Being near saltwater puts a lot of strain on the complex and requires more frequent maintenance.

- Rules & Regulations Can Be Extreme – Often times condo HOAs have more restrictive rules & regulations than a single-family home community HOA does.

- Resale Can Take Longer – Resale for a condo can sometimes take longer, although lately, this hasn’t been the case. In March 2024, the “Time to Contract” for a Condo in Palm Beach County was 37 days, while for a single-family home was 32 days. Not a big difference.

- Lacking Privacy – Condos by their very nature offer less privacy than a single-family home. You will be sharing a pool with others, you will share common entrances with others, and you will likely have someone living above you and below you.

- Pet Restrictions – Most HOAs in Florida have some sort of pet restrictions, but condos can be even more limited to what pets you can or cannot have. If you love animals, make sure you understand the rules & restrictions of the community before purchasing.

Disadvantages

- HOA Fees Can Be High – Since many condos are located by the water, and often have many amenities, the HOA dues can often be higher for condos than for a single-family home. Being near saltwater puts a lot of strain on the complex and requires more frequent maintenance.

- Rules & Regulations Can Be Extreme – Often times condo HOAs have more restrictive rules & regulations than a single-family home community HOA does.

- Resale Can Take Longer – Resale for a condo can sometimes take longer, although lately, this hasn’t been the case. In March 2024, the “Time to Contract” for a Condo in Palm Beach County was 37 days, while for a single-family home was 32 days. Not a big difference.

- Lacking Privacy – Condos by their very nature offer less privacy than a single-family home. You will be sharing a pool with others, you will share common entrances with others, and you will likely have someone living above you and below you.

- Pet Restrictions – Most HOAs in Florida have some sort of pet restrictions, but condos can be even more limited to what pets you can or cannot have. If you love animals, make sure you understand the rules & restrictions of the community before purchasing.

Looking To Buy Or Sell A Home?

Finding the perfect home or the right buyer is easier with the local expert by your side! Our trusted real estate agents are here to guide your every step of the way. Whether you're buying, selling, or just exploring your options, let us help make your real estate journey seamless and stress-free.

A SquareFootHomes Agent is Ready to Help

Things You Need To Review Before Buying a Condo in Florida

When buying a condo in Florida, you should have an inspection period. During this time it’s important you research the following items to understand what you are buying.

1. HOA Dues & Budget

Every HOA community will have an annual budget along with what the current dues are. HOA fees can be very high and its important to understand what you will be responsible for paying.

When you buy a condo the HOA dues will be disclosed to you in the rider that comes along with your contract, but that will not outline the HOA budget and where the money is going. The rider will show what you are responsible for paying and how often.

Ask your real estate agent for a copy of the latest annual budget for your review.

2. Covenants, Conditions & Restrictions

The Covenants, Conditions & Restrictions (CC&R’s) are the rules that govern the condominium complex. The CC&R’s restrict what homeowners can do on their property and the common areas. The CC&Rs may have restrictions on things such as:

- Not having vehicles larger than a certain size

- Not having certain breeds of dogs

- Noise ordinance after certain hours

- Limiting changes homeowners can make inside their condos

- Guests policies

- Collecting HOA dues

- Criteria as to who can own within the condo (minimum credit scores, for example).

Reading and understanding the condos CC&Rs is very important to avoid misunderstandings and not being satisfied with the conditions set upon you as an owner.

3. Plans for Upcoming Special Assessments

Condos can often have unplanned and immediate capital expenditures that end up being paid by each individual homeowner. For example, the building may find a structural issue that will require a very large capital expenditure, resulting in each owner paying a special assessment fee of $10,000.

This is not an uncommon occurrence. When buying a condo it’s important to find out directly from the HOA whether there are any planned capital expenditures or special assessments.

This is also outlined in the HOA rider that comes in your contract but it’s wise to obtain the information from the HOA yourself.

4. Condo Insurance Costs Can Be Very High

Insurance costs in Florida are on the rise, and that includes condos. Condos are being hit with very large cost increases to their Master HOA policy. For the HOA to cover this additional expense the owners are receiving special assessments.

Discuss this with the HOA to get an understanding of what their expectations are regarding insurance costs.

5. Condo Application & Owner Requirements

Every condo will have an application process to become either a renter or a buyer. The HOA will have its own requirements to approve the purchase such as:

- Minimum Credit Scores

- Limited residents to 2 per bedroom

- Minimum Down Payment % on Purchase

- Age Restrictions (55+ communities)

Understanding these requirements and making sure you meet them is important to understand before spending your money on other parts of the inspection period. Why hire a home inspector if you’re credit score is too low for the community?

Back

Back